The name of the country itself hints that the climate there is not very warm. And this is where all of its charm is hiding: it’s like the Snow Queen looking at you with her cold piercing eyes. And you can spend ages looking at this country: the waterfalls, the rocks, the volcanos, the beaches with black sand, and 8 months a year when you can see the Northern Lights. All these things make Iceland a country from a parallel reality that anyone would love to go to, at least for a little vacay.

We at Bright Side think that there should be things to fuel our dreams and this article does exactly that. Now is probably the best time to start saving for a trip to Iceland to see its beauty with your own eyes. It’s definitely worth it.

“My sister rented an apartment in the north of Iceland for Christmas, and this is her view.”

Before 1987, every Thursday in Iceland, there were no TV broadcasts.

The people from Iceland born before 1987 joke that they were probably conceived on a Thursday. The thing is, Thursdays were the days of communication when people were supposed to pay more attention to each other. This is why the only channel in the country at the time didn’t work on Thursdays.

Footage from the Icelandic TV show Keeping up with the Kattarshians, where cats are filmed living in a tiny home

Black sand beach in Iceland

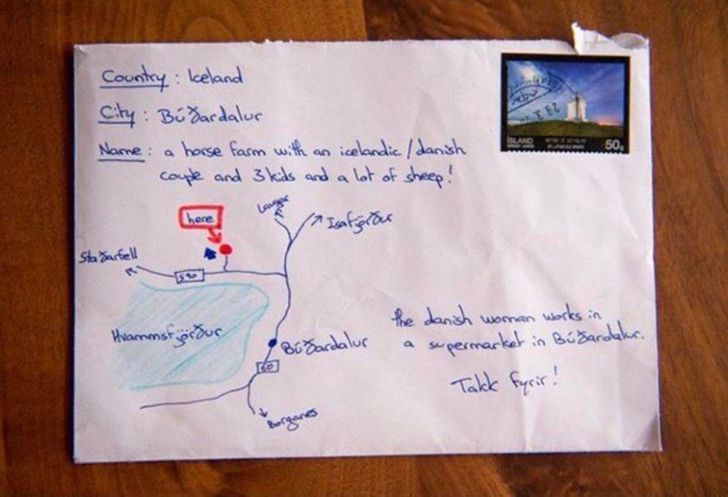

“In Iceland, you can hand-draw a map on your mail, without an address, and it will still make it to its destination.”

- That’s because buildings are so far apart from each other and there are lots of distinct geographical locations, so it is easy to determine the location. The-Daily-Meme / Reddit

Blue Lagoon in Iceland is a geothermal hot spring that wasn’t open to tourists until the 1990s.

- That’s insane, it simultaneously looks like the hottest and coldest place on the planet. obamium-11 / Reddit

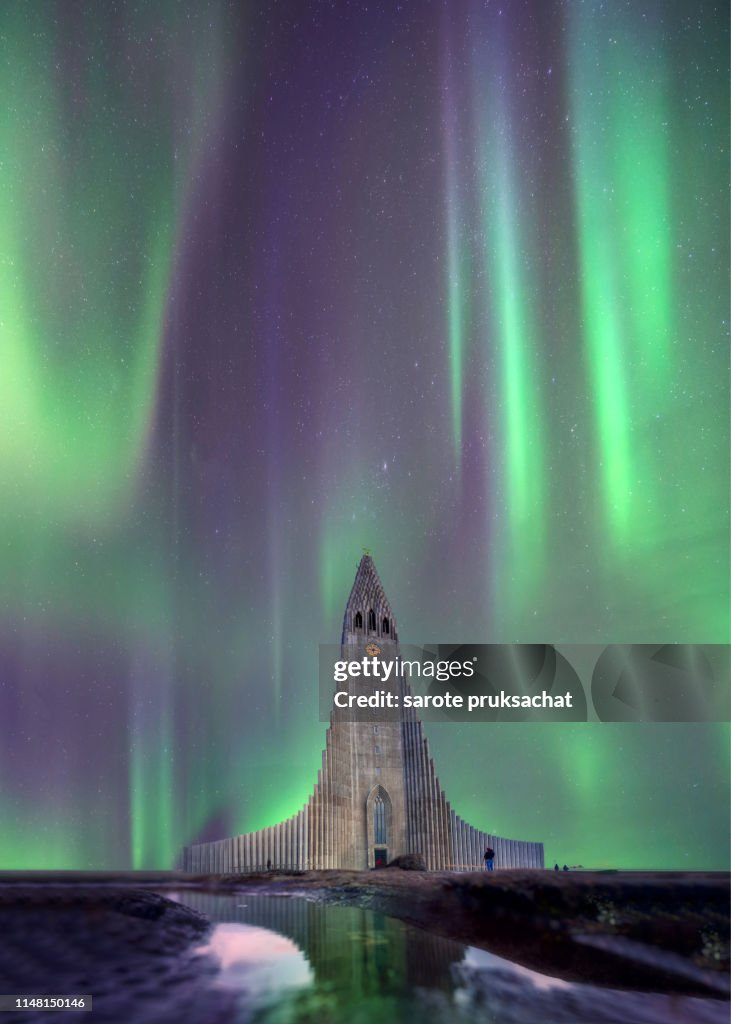

The people in Iceland can see the Northern Lights 8 months a year.

- Wow… one of the things I’d really like to see some time in my lifetime… FrayAdjacent / Reddit

“There are places in Iceland where you can be standing on the North American and European tectonic plates at the same time. This rift was from an earthquake.”

There’s a cave shaped like Yoda in Iceland. Do you see it?

“Iceland does not want to deal with your stupidity — and I think that’s beautiful.”

“Traveling within Iceland because we couldn’t go elsewhere. Found these guys sheltering themselves from the wind…”

And there’s a magnificent glacier in the background!

Glacier rivers in Iceland

- I used to have an art teacher who went to Iceland every year. He had hundreds of photos of the countryside. I have never seen anything like this country. The bizarre colors and shapes that naturally occur there are nothing more than breathtaking. JanJaapen / Reddit

A black church called the Heimaey Stave Church

- I was fortunate enough to see this church in person last year. There is a spring/fountain very close nearby with some of the cleanest and tastiest water I’ve ever had. Hard to even describe. Sletzer / Reddit

The Kerið Crater in winter is unreal.

“A photo of a road and landscape I took”

- Looks like wallpaper for an iPad pro. maurosauro / Reddit

- I’d be happy to sell it to Apple. thomyorkeftw / Reddit

The last McDonald’s cheeseburger sold in Iceland. McDonald’s no longer exists in this country.

“Stayed in an unusual hotel near The Golden Circle in Iceland”

“This crater lake in Iceland merges with a powerful glacial river. One of the most surreal sunrises I’ve ever experienced”

This very cozy street in Iceland

- This whole country is cozy. Seriously. I went there last winter and I’ve never been to a more cozy place in my life. dc-redpanda / Reddit

The view from some public restrooms in Iceland

“The puffins returned to eastern Iceland this week. I was lucky enough to see thousands of them in one spot.”

“This house my wife and I stayed at while in Iceland”

- Pretty much every building in Iceland has a view as good as this, that country is just insane. Chilis1 / Reddit

A sunset snowstorm in Iceland

I have the urge to set this as my phone’s wallpaper.

Would you like to travel to this amazing country?

What’s fair in this case?

Moving in together is a big step in any relationship. It symbolizes commitment, partnership, and the exciting journey of sharing a home. But let’s be honest—living together also comes with financial realities that can’t be ignored. One of the most common dilemmas couples face is how to fairly split rent when income levels are unequal.

Consider this scenario: A man earns $65,000 per year, while his partner earns $33,000 per year. Together, they are renting an apartment for $2,000 per month. Should they split the rent 50/50, or is there a better way to handle it?

Let’s dive into the different approaches and find the fairest way to split rent without creating financial strain or resentment in the relationship.

Assessing Income Disparities in Cohabiting Couples

It’s rare for couples to earn the exact same income, and when one person earns significantly more, a strict 50/50 split may not be the best solution.

A 50/50 division might feel fair on paper, but in practice, it could financially strain the lower-earning partner, making them struggle to cover other essential expenses like groceries, utilities, and savings.

Instead of treating rent like a simple split, it’s important to evaluate each person’s income, debts, and financial responsibilities to find a balance that respects both partners’ financial health.

Method 1: Splitting Rent Based on Income Proportion

One of the fairest ways to split rent when incomes are unequal is by dividing it proportionally based on each partner’s earnings.

In this case:

- The man earns $65,000 annually, which is 66% of the total income.

- The woman earns $33,000, which is 34% of the total income.

- Applying these percentages to the $2,000 rent:

- The man would pay $1,320 (66%)

- The woman would pay $680 (34%)

This method ensures that both partners contribute relative to what they can afford, preventing financial strain on the lower-income partner.

Video : What rights do cohabiting couples have?

Method 2: Using a Fixed Percentage of Income for Rent

Another approach is for both partners to contribute the same percentage of their individual income towards rent.

For example, if they agree to allocate 30% of their income to rent:

- The man would pay $1,625 per month (30% of his $65,000 annual income divided by 12).

- The woman would pay $825 per month (30% of her $33,000 annual income divided by 12).

This approach ensures that both individuals spend the same proportion of their income on housing, making it fairer and more sustainable.

Method 3: Balancing Costs with Other Household Expenses

Sometimes, splitting rent isn’t just about the rent itself. Couples can balance their financial contributions by dividing other household costs differently.

For example:

- If they split rent equally, the lower-income partner can contribute more towards groceries, utilities, and household chores to compensate for the difference.

- Alternatively, the higher-earning partner can take on larger financial responsibilities, such as paying for furniture, car payments, or entertainment expenses.

This method works best when both partners agree on what feels fair and sustainable in the long run.

The Key to Success: Open and Honest Communication

Money can be a touchy subject, but avoiding financial discussions leads to misunderstandings, stress, and resentment. To create a successful co-living arrangement:

- Have an open conversation about finances before moving in together.

- Discuss income, debts, savings goals, and spending habits to ensure transparency.

- Agree on a financial plan that works for both partners—whether that means proportional rent, shared expenses, or a mix of both.

- Revisit and adjust the agreement as incomes and financial situations change over time.

The goal isn’t just to split rent fairly—it’s to build trust and financial harmony in the relationship.

Other Shared Expenses: What Else Needs to Be Considered?

Rent isn’t the only financial commitment when living together. Couples should also plan for:

- Utilities (electricity, water, internet)

- Groceries and dining out

- Car payments or transportation costs

- Streaming services, gym memberships, and subscriptions

- Savings for vacations or emergencies

A simple budgeting plan that includes all shared expenses helps both partners contribute fairly while ensuring financial stability.

Financial Stress and Relationship Strain: How to Avoid Conflict

Money is one of the top reasons couples argue, especially when income disparities exist. Here’s how to avoid unnecessary stress:

- Set Clear Expectations – Before moving in, agree on how to divide rent and expenses in a way that feels fair to both.

- Avoid Keeping Score – Instead of focusing on exact numbers, consider overall contributions to the household. One partner may contribute more financially, while the other handles more household responsibilities.

- Be Flexible – Financial situations change. One partner may get a raise, lose a job, or take on unexpected expenses. Be willing to adjust contributions as needed.

- Respect Each Other’s Financial Goals – If one person is saving aggressively for the future, while the other prefers a more relaxed spending approach, find a middle ground that supports both perspectives.

Legal Considerations for Cohabiting Couples

Even though cohabiting partners aren’t legally married, financial responsibilities can still have legal implications. It’s a good idea to:

- Put both names on the lease to ensure equal housing rights.

- Consider a cohabitation agreement outlining rent payments and shared financial responsibilities.

- Discuss property ownership if purchasing a home together in the future.

Legal planning might seem unnecessary, but it can prevent potential conflicts or misunderstandings down the line.

Video : The Secret to Financial Success as a Couple…

Conclusion: The Best Approach Is One That Works for Both Partners

There’s no one-size-fits-all rule when it comes to splitting rent as a couple. The most important thing is to find a method that feels fair, manageable, and sustainable for both partners.

Whether you divide rent proportionally, set a fixed percentage of income, or balance expenses in other ways, the key to success is open communication, mutual respect, and financial transparency.

Living together is about building a future—not just sharing a space. By handling financial discussions with maturity and fairness, couples can create a harmonious and stress-free home environment.

How do you and your partner handle rent and expenses? Share your thoughts in the comments below!

Leave a Reply