The singer of “Mirrors” gave up ownership of the verdant plot of land just a few weeks before his conviction for DWI on June 18.

Officially, Justin Timberlake has bid farewell to a sizable tract of land in Tennessee.

The forty-three-year-old singer of “Mirrors” sold his approximately 127-acre Franklin, Tennessee, property for $8 million. According to the listing, it’s tucked away “less than half a mile” from the quiet community of Leipers Fork and about 45 minutes outside of Nashville.

Not only does the property provide breathtaking vistas of Leipers Creek Valley, but it also has 50 acres of pastures and wildlife food plots. On-site features include footpaths, spring creeks, and a fishing pond.

The listing was held by Tom Sullivan of Covey Rise Properties.

According to property documents, Timberlake legally relinquished ownership of the expansive site on May 30, while on his current Forget Tomorrow World Tour.

The Tennessean claims that the Memphis native bought the land in 2015 from local preservationist and philanthropist Aubrey Preston.

Preston told the site that he and the Grammy winner have a great deal of affection for their home state, nearly a year after Timberlake’s acquisition.

At the time, Preston remarked, “We both love Tennessee and loved growing up on land.” “We want to do our share to protect that for our children and future generations. We got to know one another in this way.

The transaction occurred just a few weeks prior to Timberlake’s June 18 arrest in Sag Harbor, New York, for allegedly driving under the influence.

He was stopped by a Sag Harbor policeman while traveling from the American Hotel to a friend’s house. Subsequently, the singer was issued two citations for failure to maintain lane integrity and one count of driving while intoxicated.

Although Timberlake’s arrest has sparked a frenzy among the public and his fans, a source tells PEOPLE that he and wife Jessica Biel are unconcerned about the event.

“They have put the arrest behind them. The insider stated, “They continue to put work and family first and have faith in their legal team.” Timberlake and the actress from The Better Sister are parents to two kids, Phineas, 4, and Silas, 9.

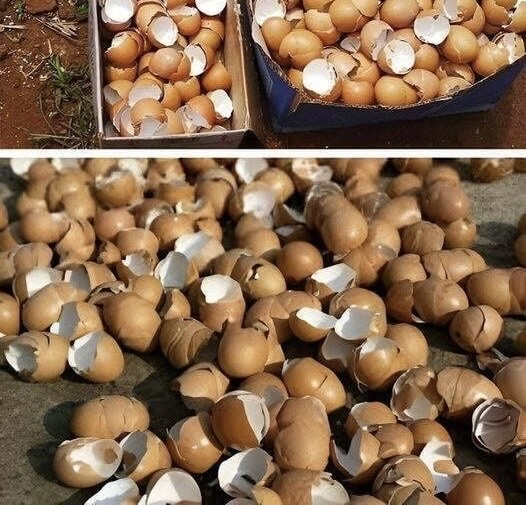

Boiling Eggshells: Save Money and Help the Environment

Ever wonder how many eggshells people throw away in the trash? It really is a lot! However, did you realize that boiling these inconsequential-looking shells can really result in financial savings? It’s also a fantastic technique to lessen trash and contribute to environmental preservation. Now let’s explore the several advantages of reusing eggshells!

Eggs: A Powerhouse of Nutrition

In addition to being tasty and adaptable, eggs are also a great source of important nutrients. They include excellent sources of lipids, proteins, vitamins, and minerals, making them a full meal. About 6 grams of protein may be found in one egg, which is an essential component for sustaining muscle mass and meeting your daily dietary requirements. Protein is essential for maintaining a healthy immune system in addition to being necessary for muscles.

Cracking the Secret Code of Eggshells

Let’s now discuss eggshells. Though many of us just toss them out without giving them any thought, these “throwaways” actually have a lot to give. The main component of eggshells is calcium carbonate, which is also a component of antacid drugs. This implies that they may be a fantastic supply of calcium, a mineral that is necessary for healthy bones.

Eggshells may readily have the calcium extracted from them by boiling them, which makes for an inexpensive, natural, and DIY calcium supplement. Because strong bones become ever more dependent on calcium as we age, this is especially advantageous for elderly folks.

Easy Steps for Recycling Eggshells

Are you prepared to start maximizing your eggshells and cutting costs? Here’s a short, detailed how-to:

Gather and tidy: After giving empty eggshells a thorough rinse, let them air dry.

Crush the shells: Using a food processor or mortar and pestle, break the shells into little pieces once they have dried.

Bring the crushed shells to a boil by putting them in a pot with water and covering them. Simmer it for ten to fifteen minutes.

Strain and cool: To get rid of any shell bits, strain the liquid after it has simmered. Let cool completely before putting it in a fresh bottle or jar.

Utilize and delight in: You can now utilize your own calcium supplement. Take one tablespoon of the liquid every day, stir it into your preferred drink, or incorporate it into your meals.

Reduce Spending, Protect the Environment, and Boost Your Health

Not only is boiling eggshells a cost-effective decision, but it’s also an environmentally beneficial one. You can obtain a natural calcium supply that promotes bone health and general wellbeing by recycling these shells. Thus, keep in mind to save and repurpose the eggshells the next time you crack open an egg!

Leave a Reply