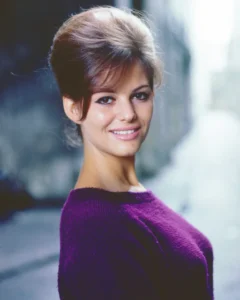

Famous actress Claudia Cardinale has embraced aging gracefully, believing that time is unstoppable. Her approach shows a natural and inspiring transformation through the years.

Instead of turning to surgery, Claudia has chosen to accept each stage of life. She believes true beauty comes from within, a mindset that has gained her admiration from fans worldwide.

Her transformation over the years shows her confidence in aging naturally. Claudia’s appearance is a testament to her strength and timeless elegance, proving that beauty truly knows no age.

Source: Getty Images

Italian actress Claudia Cardinale was a big name during Hollywood’s golden age. Over her long career, she appeared in more than 100 films, especially from 1960 to 1970.

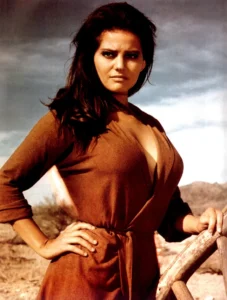

During that decade, she acted in about 30 movies, including famous titles like 8½ (1963), The Leopard (1963), and The Professionals (1966), where she starred with Burt Lancaster and Lee Marvin.

Another memorable role was in Once Upon a Time in the West (1968), directed by the legendary Sergio Leone. Cardinale recalls that Leone had a unique style, often playing the music for a scene before filming it.

Reflecting on her U.S. career, Cardinale said, “I didn’t ask to go to Hollywood; they called me.” At that time, Hollywood studios quickly signed up new stars under strict contracts, which limited actors’ freedom in their careers.

Cardinale resisted this, avoiding an exclusive deal with Universal Studios. She preferred signing one contract at a time, allowing her to build a career on her own terms.

In her three years in Hollywood, Cardinale acted in movies like The Pink Panther and The Professionals, working with famous actors such as Rock Hudson in Blindfold and sharing the screen with John Wayne and Rita Hayworth in Circus World.

During this time, she met many Hollywood icons, including Barbra Streisand, Steve McQueen, and Warren Beatty.

In 1961, Cardinale attended Cannes for the first time, promoting films like Girl With a Suitcase and The Lovemakers. She returned to Cannes in 1963 with The Leopard and 8½, both highly acclaimed movies.

Shooting two films at once was challenging, as each director wanted a different look for her. She dyed her hair dark for Visconti and went blonde for Fellini, switching colors every two weeks.

Later, she returned to Hollywood, starring in films with Rock Hudson like Blindfold and Lost Command. Cardinale was offered an exclusive contract with Universal, but she declined, saying, “No, I’m European. I’m going back.” She stayed true to herself, resisting the pressure.

Unlike some actresses, Cardinale never appeared in nude scenes and stayed clear of cosmetic surgery. She believes in showing her true self. “I’ve never done – what do you call it? – a facelift,” she once said, explaining her decision to age naturally.

Now 86, Cardinale still works in the entertainment industry. Her recent project was the Tunisian-Italian film The Island of Forgiveness. About staying active, she said, “I don’t like all these facelifts and plastic surgery because you can’t stop time.”

Starting from the “Most Beautiful Italian Girl in Tunisia” in 1957, Cardinale’s journey reflects her strength and beauty. Her story shows that true beauty lies in embracing oneself and staying genuine.

What’s fair in this case?

Moving in together is a big step in any relationship. It symbolizes commitment, partnership, and the exciting journey of sharing a home. But let’s be honest—living together also comes with financial realities that can’t be ignored. One of the most common dilemmas couples face is how to fairly split rent when income levels are unequal.

Consider this scenario: A man earns $65,000 per year, while his partner earns $33,000 per year. Together, they are renting an apartment for $2,000 per month. Should they split the rent 50/50, or is there a better way to handle it?

Let’s dive into the different approaches and find the fairest way to split rent without creating financial strain or resentment in the relationship.

Assessing Income Disparities in Cohabiting Couples

It’s rare for couples to earn the exact same income, and when one person earns significantly more, a strict 50/50 split may not be the best solution.

A 50/50 division might feel fair on paper, but in practice, it could financially strain the lower-earning partner, making them struggle to cover other essential expenses like groceries, utilities, and savings.

Instead of treating rent like a simple split, it’s important to evaluate each person’s income, debts, and financial responsibilities to find a balance that respects both partners’ financial health.

Method 1: Splitting Rent Based on Income Proportion

One of the fairest ways to split rent when incomes are unequal is by dividing it proportionally based on each partner’s earnings.

In this case:

- The man earns $65,000 annually, which is 66% of the total income.

- The woman earns $33,000, which is 34% of the total income.

- Applying these percentages to the $2,000 rent:

- The man would pay $1,320 (66%)

- The woman would pay $680 (34%)

This method ensures that both partners contribute relative to what they can afford, preventing financial strain on the lower-income partner.

Video : What rights do cohabiting couples have?

Method 2: Using a Fixed Percentage of Income for Rent

Another approach is for both partners to contribute the same percentage of their individual income towards rent.

For example, if they agree to allocate 30% of their income to rent:

- The man would pay $1,625 per month (30% of his $65,000 annual income divided by 12).

- The woman would pay $825 per month (30% of her $33,000 annual income divided by 12).

This approach ensures that both individuals spend the same proportion of their income on housing, making it fairer and more sustainable.

Method 3: Balancing Costs with Other Household Expenses

Sometimes, splitting rent isn’t just about the rent itself. Couples can balance their financial contributions by dividing other household costs differently.

For example:

- If they split rent equally, the lower-income partner can contribute more towards groceries, utilities, and household chores to compensate for the difference.

- Alternatively, the higher-earning partner can take on larger financial responsibilities, such as paying for furniture, car payments, or entertainment expenses.

This method works best when both partners agree on what feels fair and sustainable in the long run.

The Key to Success: Open and Honest Communication

Money can be a touchy subject, but avoiding financial discussions leads to misunderstandings, stress, and resentment. To create a successful co-living arrangement:

- Have an open conversation about finances before moving in together.

- Discuss income, debts, savings goals, and spending habits to ensure transparency.

- Agree on a financial plan that works for both partners—whether that means proportional rent, shared expenses, or a mix of both.

- Revisit and adjust the agreement as incomes and financial situations change over time.

The goal isn’t just to split rent fairly—it’s to build trust and financial harmony in the relationship.

Other Shared Expenses: What Else Needs to Be Considered?

Rent isn’t the only financial commitment when living together. Couples should also plan for:

- Utilities (electricity, water, internet)

- Groceries and dining out

- Car payments or transportation costs

- Streaming services, gym memberships, and subscriptions

- Savings for vacations or emergencies

A simple budgeting plan that includes all shared expenses helps both partners contribute fairly while ensuring financial stability.

Financial Stress and Relationship Strain: How to Avoid Conflict

Money is one of the top reasons couples argue, especially when income disparities exist. Here’s how to avoid unnecessary stress:

- Set Clear Expectations – Before moving in, agree on how to divide rent and expenses in a way that feels fair to both.

- Avoid Keeping Score – Instead of focusing on exact numbers, consider overall contributions to the household. One partner may contribute more financially, while the other handles more household responsibilities.

- Be Flexible – Financial situations change. One partner may get a raise, lose a job, or take on unexpected expenses. Be willing to adjust contributions as needed.

- Respect Each Other’s Financial Goals – If one person is saving aggressively for the future, while the other prefers a more relaxed spending approach, find a middle ground that supports both perspectives.

Legal Considerations for Cohabiting Couples

Even though cohabiting partners aren’t legally married, financial responsibilities can still have legal implications. It’s a good idea to:

- Put both names on the lease to ensure equal housing rights.

- Consider a cohabitation agreement outlining rent payments and shared financial responsibilities.

- Discuss property ownership if purchasing a home together in the future.

Legal planning might seem unnecessary, but it can prevent potential conflicts or misunderstandings down the line.

Video : The Secret to Financial Success as a Couple…

Conclusion: The Best Approach Is One That Works for Both Partners

There’s no one-size-fits-all rule when it comes to splitting rent as a couple. The most important thing is to find a method that feels fair, manageable, and sustainable for both partners.

Whether you divide rent proportionally, set a fixed percentage of income, or balance expenses in other ways, the key to success is open communication, mutual respect, and financial transparency.

Living together is about building a future—not just sharing a space. By handling financial discussions with maturity and fairness, couples can create a harmonious and stress-free home environment.

How do you and your partner handle rent and expenses? Share your thoughts in the comments below!

Leave a Reply