For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

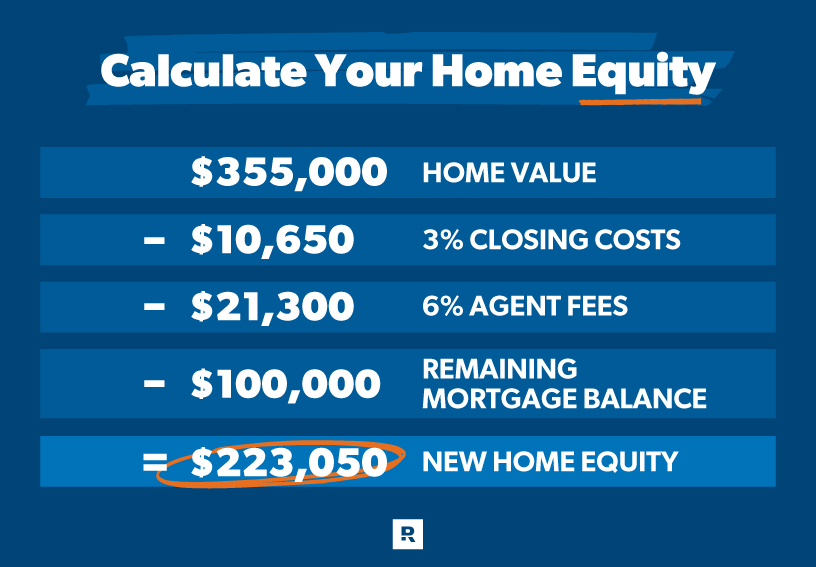

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

Florida orders residents to evacuate as Hurricane Milton continues to intensify.

A storm surge warning has been reissued for several areas in Florida as Milton intensifies with wind speeds of 161 km/h, continuing to strengthen and becoming a major hurricane by the end of October 7th.

Residents along Florida’s coast have just endured the devastating Hurricane Helene in recent days and now face new evacuation orders as the U.S. National Hurricane Center (NHC) on October 7th warned that Hurricane Milton is strengthening to Category 3 on the five-tier scale, with the potential to cause severe damage.

The NHC noted that a storm surge warning has been reissued for several areas in Florida as Milton intensifies with wind speeds of 161 km/h, continuing to strengthen and becoming a major hurricane by the end of October 7th.

The hurricane is expected to move north of the Yucatán Peninsula and cross the southern Gulf of Mexico on October 7th-8th. It could potentially make landfall on Florida’s west coast.

The risk of storm surge during Hurricane Milton could reach 0.6 to 1.2 meters above sea level along the northern coast of the Yucatán Peninsula, causing large, destructive waves.

According to the NHC, major hurricanes—Category 3 or higher—have a minimum wind speed of 178 km/h and pose the risk of “catastrophic damage,” even to well-constructed homes. Power and water outages may last for several days or weeks after the storm passes.

Tampa County official Jane Castor stated that the area is still recovering from Hurricane Helene, and the incoming rain from Milton will add more challenges, not to mention storm surges and wind damage.

President Joe Biden emphasized that the federal government is preparing resources for storm response and rescue efforts.

Earlier that day, Florida Governor Ron DeSantis extended the state of emergency to 51 of the state’s 67 counties, warning that Hurricane Milton could have “significant impacts.”

Meanwhile, rescue teams are still racing to find those missing after Hurricane Helene, which hit the U.S. on September 27th, resulting in 225 fatalities across several states.

Leave a Reply